Hey there, Gen Alpha! You might think insurance is something only adults need to worry about, but guess what? It’s never too early to start thinking about it. Understanding and budgeting for insurance can set you up for financial success down the road. Let’s dive into why insurance matters and how you can smartly budget for it.

Budgeting for Insurance

What is Insurance?

Insurance is like a safety net for unexpected events. It’s a way to protect yourself financially if something goes wrong, like getting sick, having a car accident, or experiencing damage to your home.

Different Types of Insurance

Health Insurance

Health insurance covers medical expenses. It’s essential for covering doctor visits, hospital stays, and prescriptions.

Life Insurance

Life insurance provides financial support to your loved ones if something happens to you. It’s especially important if you have dependents.

Auto Insurance

Auto insurance covers costs associated with car accidents. It’s usually required by law if you own a car.

Home Insurance

Home insurance protects your home and belongings from damage or theft. If you own a home, this is a must-have.

Renters Insurance

Renters insurance covers your personal belongings in a rental property. It’s great for protecting your stuff if you don’t own your home.

The Basics of Budgeting

What is Budgeting?

Budgeting is simply creating a plan for your money. It helps you track your income and expenses, ensuring you spend within your means.

Benefits of Budgeting

Budgeting helps you save money, avoid debt, and ensure you have enough for essential expenses like insurance.

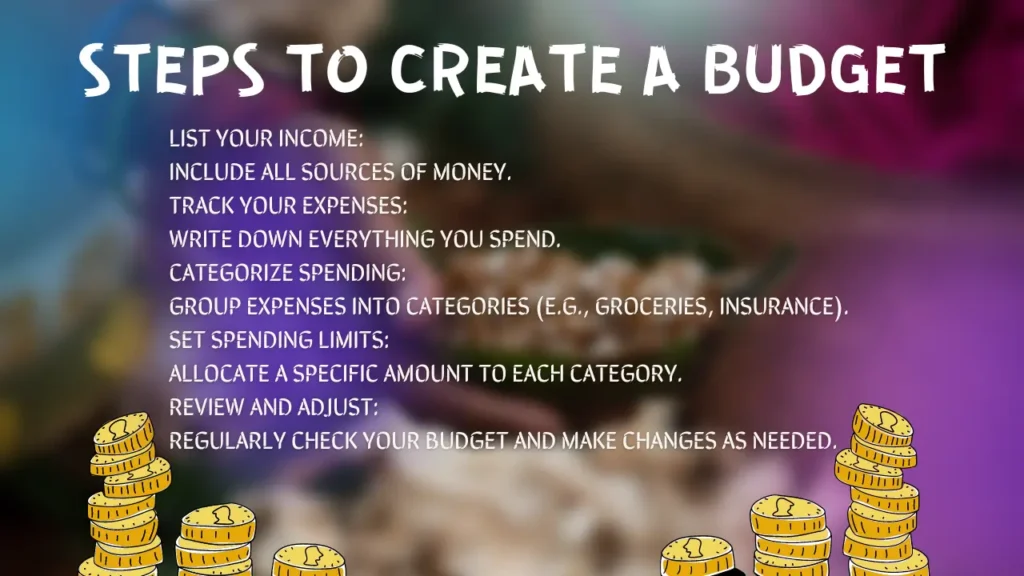

Steps to Create a Budget

List Your Income: Include all sources of money.

Track Your Expenses: Write down everything you spend.

Categorize Spending: Group expenses into categories (e.g., groceries, insurance).

Set Spending Limits: Allocate a specific amount to each category.

Review and Adjust: Regularly check your budget and make changes as needed.

Budgeting for Insurance: Key Tips

Assessing Your Insurance Needs

Evaluate what types of insurance you need based on your lifestyle and financial situation.

Comparing Insurance Policies

Shop around and compare different insurance policies to find the best coverage at the best price.

Considering Deductibles and Premiums

Understand the balance between deductibles (what you pay out-of-pocket) and premiums (your monthly payment). Higher deductibles usually mean lower premiums and vice versa.

Looking for Discounts

Many insurance companies offer discounts for things like bundling policies, having a good driving record, or being a student with good grades.

Evaluating Your Current Coverage

Regularly review your insurance policies to ensure you have the right amount of coverage and are not overpaying.

Health Insurance for Gen Alpha

Importance of Health Insurance

Health insurance is crucial for covering medical expenses and protecting your health and finances.

Tips for Choosing Health Insurance

Look for comprehensive coverage.

Check if your preferred doctors are in-network.

Consider the cost of premiums and out-of-pocket expenses.

Budgeting for Health Insurance

Include health insurance premiums in your budget and set aside money for potential out-of-pocket costs.

Life Insurance for Gen Alpha

Why Life Insurance is Important

Life insurance can provide financial security for your family or dependents if something happens to you.

Types of Life Insurance

Term Life Insurance: Coverage for a specific period.

Whole Life Insurance: Coverage for your entire life, often with a savings component.

Budgeting for Life Insurance

Choose a policy that fits your budget and meets your needs. Term life insurance is usually more affordable.

Auto Insurance for Gen Alpha

Necessity of Auto Insurance

Auto insurance is required by law and protects you financially in case of car accidents.

Factors Affecting Auto Insurance Costs

Your driving record

Type of car you drive

Where you live

Coverage limits

Budgeting for Auto Insurance

Compare different policies and choose one that provides the necessary coverage at a price you can afford.

Home and Renters Insurance

Understanding Home Insurance

Home insurance covers damage to your home and personal belongings, as well as liability for accidents that happen on your property.

Understanding Renters Insurance

Renters insurance covers your personal belongings in a rental property and provides liability coverage.

Budgeting Tips for Home and Renters Insurance

Include these premiums in your budget and look for discounts, such as bundling with auto insurance.

Technology and Tools for Budgeting

Budgeting Apps and Tools

Use apps like Mint, YNAB (You Need A Budget), or PocketGuard to track your spending and manage your budget.

Online Resources for Insurance Comparisons

Websites like NerdWallet, Policygenius, and Compare.com can help you compare insurance policies and find the best rates.

Financial Literacy Apps for Gen Alpha

Apps like Bankaroo, PiggyBot, and iAllowance can teach you about budgeting and saving money in a fun, interactive way.

Common Mistakes to Avoid

Underinsuring or Overinsuring

Make sure you have enough coverage but avoid paying for unnecessary extras.

Ignoring Policy Details

Always read the fine print to understand what your policy covers and excludes.

Not Reviewing Policies Regularly

Review your policies annually to ensure they still meet your needs.

Overlooking Discounts and Deals

Don’t miss out on potential savings by failing to ask about discounts.

The Role of Parents and Guardians

Educating Gen Alpha About Insurance

Parents should teach their kids about the importance of insurance and how it works.

Involving Kids in Budgeting Activities

Include children in budgeting exercises to give them hands-on experience.

Setting a Good Example

Parents can set a good example by managing their own finances responsibly.

Future Trends in Insurance for Gen Alpha

Innovations in the Insurance Industry

Expect more personalized and technology-driven insurance options in the future.

How Gen Alpha’s Insurance Needs Might Change

As lifestyles and technology evolve, insurance needs will also change. Stay informed about new trends and products.

Preparing for Future Insurance Trends

Stay educated about emerging trends and be ready to adapt your insurance coverage accordingly.

Conclusion

Budgeting for insurance might seem overwhelming at first, but it’s a critical skill for financial success. By understanding your needs, comparing policies, and using the right tools, you can ensure you’re adequately covered without breaking the bank. Start today and secure your financial future!

FAQs

What age should you start thinking about insurance?

It’s never too early to start learning about insurance. Understanding the basics as a teenager can prepare you for making informed decisions as an adult.

How can you find affordable insurance?

Compare policies from different providers, look for discounts, and consider bundling multiple types of insurance for better rates.

What are the most important types of insurance for young people?

Health, auto, and renters insurance are typically the most important for young people.

How often should you review your insurance policies?

Review your insurance policies at least once a year or whenever you have a major life change.

What should you do if you can’t afford insurance?

Look for government assistance programs, seek out plans with lower premiums, or consider increasing your deductibles to reduce your monthly costs.